An inaugural Sukuk issurance by the Bank of Mauritius (paragraph 100 (d) of the Budget)

Sukuk issuance & trading has been rapidly growing in the past and has continued to have promising growth potential in markets, such as the UK, Middle East & North Africa (MENA) and South East Asia. The UK Government plans to issue its second sovereign sukuk issue this year. To many, the word “Sukuk” itself is alien. Hence the purpose of this article is to enlighten readers about Sukuk.

To begin with, no issuance of Sukuk is ever made in Mauritius and it was first proposed in the 2009 budget in paragraph 124: “Government is exploring the possibility for developing sovereign debts that are Sharia compliant, namely the ‘sukuk’” and in the same year, the Public Debt Management Act 2008 was amended to include the following:

(3A) The Minister may enter into such agreement, sell, purchase or otherwise acquire any immovable property or any right therein, lease movable or immovable property and generally engage in such transactions and perform such activities as may be reasonably necessary for the purpose of issuing Sovereign Sukuks in Mauritius.

And henceforth, Sovereign Sukuks were considered as government securities, just like treasury bills and treasury notes bonds.

An issuance may have been attempted after 9 years. The Finance (Miscellaneous Provisions) Act 2018 provided that the income tax exemption granted on interest income received from debentures and bonds quoted on the stock exchange will be extended to returns from Sukuks.

Now, what is Sukuk? How does it work and does it differ from conventional Bonds?

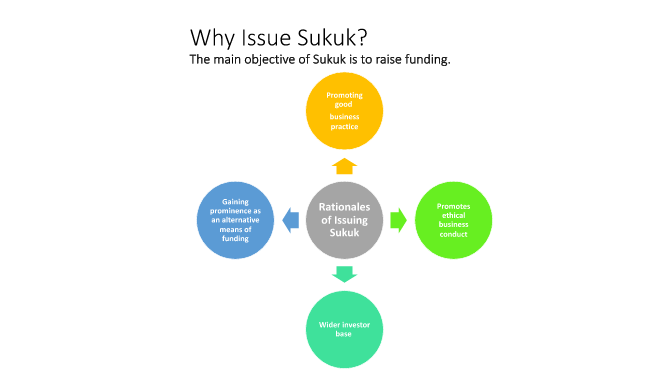

To put it simply, Sukuk is an investment instrument that allows the issurer (if you like the ‘borrower’ in the traditional understanding) to raise fund from a capital market, instead of a banking institution. It also provides a new form of funding structure for all categories of issuers: governments, corporations and banks.

In business, when a corporation needs financing or simply more cash to support their working capital, capital expenditure, refinancing or all or them, they have an option to avail themselves to banks, to issue more shares or simply issue preference shares. While borrowing or getting financing from banks may result in relatively higher costs, due to the counterparties being banks instead of wider investors, issuing new shares will dilute the stake of the existing shareholders.

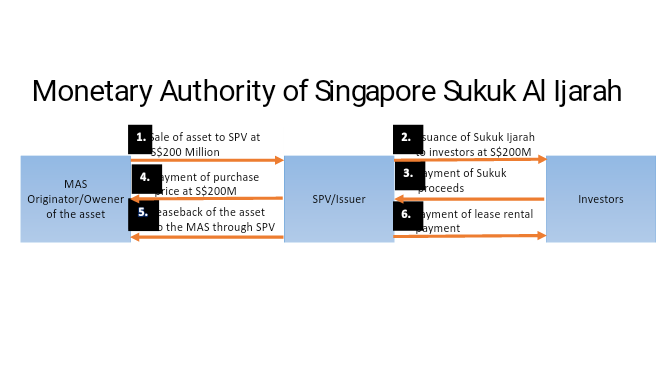

Sukuk is a financial instrument to help the issuer obtain the necessary funding. Conventionally, issues can simply bond to raise money and can pay back this money comprising of both the principal amount and the coupon. In the case of sukuk and Islamic investors, borrowing and lending money for a contractual additional premium is a non-starter. This is technically known as “riba” (interest), which is categorically prohibited in Islamic Finance. Therefore how does it work? The Monetary Authority of Singapore (MAS) Debut Sukuk will be our example (figure 2) to understand Sukuk.

MAS inaugural Sovereign Sukuk was issued in 2009. MAS Sukuk is based on sale and lease-back to replicate the conventional Singapore Government Securities (“SGS”). Hence, its returns (i.e. periodic rental payments) will be benchmarked to the risk-free yield of those SGS. The assets leased from the special purpose vehicle to MAS will be parts of the MAS building. This type of Sukuk is called Sukuk Al Ijarah. There are 14 types of Sukuk according to the Accounting and Auditing Organisation for Islamic Financial Institution (AAOIFI).

Thus you can observe that Investment Sukuk is distinguished from common shares and bonds. While shares represent the ownership of a company as a whole and are for an indefinite period, Sukuk represent specified assets and are for a given period of time (so far issued for periods ranging from three months to ten years). Sukuk, unlike bonds, carry returns based on cash flow originating from the assets on the basis of which they are issued.

Sukuk then represents a kind of ownership by the Sukuk investors over certain assets or any other underlying “element” which is acceptable to the Sharia principles and which also makes sense from a commercial perspective. The coupon received is not tantamount to “riba” because the whole arrangement is not based on money lending and borrowing, as in the case of conventional bonds.

To conclude, the issuance of Sukuk is.an alternative mode of financing and is mainly issued against an underlying asset. There are a number of underlying assets that can facilitate a Sukuk transaction. Some examples are Lands & Buildings, Aircrafts & Vessels & Metro and Equipment & Machinery.

Last and not least, Sukuk may be issued to finance the budget deficit financing in general and in-infrastructure projects.

Munir Daud Lallmahamod

![[Message de l’Eid-Ul-Fitr 2024] Atteindre la piété… Et après ???](https://sundaytimesmauritius.com/wp-content/uploads/2023/10/Bashir-new-218x150.jpg)

![[Democracy Watch Mauritius] The Rwanda genocide started 7th April 1994, 30 years ago. Has humankind learnt the lesson? Consider Israel’s action in GAZA today!](https://sundaytimesmauritius.com/wp-content/uploads/2024/03/democracy_0-218x150.jpg)

![[Mer Rouge] Le Mouvement Anti-Pollution s’oppose à l’implémentation d’une raffinerie de graphite](https://sundaytimesmauritius.com/wp-content/uploads/2024/04/Mer-Rouge-150x150.jpg)

![[Mer Rouge] Le Mouvement Anti-Pollution s’oppose à l’implémentation d’une raffinerie de graphite](https://sundaytimesmauritius.com/wp-content/uploads/2024/04/Mer-Rouge-100x70.jpg)